Is the Free Market Going to Crash Again

eleven Min Read | Oct half dozen, 2021

For everyone who has been holding their breath while watching stocks in 2021—only hoping the carpeting won't be pulled out from nether them—July nineteen sure wasn't their 24-hour interval. That's when the stock market took its biggest striking of the twelvemonth, with the Dow Jones falling ii.1%, the S&P 500 dropping ane.6%, and the Nasdaq tumbling one.i%.1Look, it'due south good to exist in the know almost what's going on, but at the end of the day, worrying volition only cause harm, non good.

Oh, and for the tape—past the end of the week, the market place had recovered.2

So, volition we see the stock market crash during the rest of 2021? Allow'south take a look at some of the major factors (with a cool, level head) to better understand where the market is going.

What Is a Stock Market place Crash?

A stock market crash is a sudden and large drop in the value of stocks, which causes investors to sell their shares apace. When the value of stocks goes down, and then does their cost—and the finish outcome is that people could lose a lot of the money they invested.

Craft a harder-working money programme with a trusted financial pro.

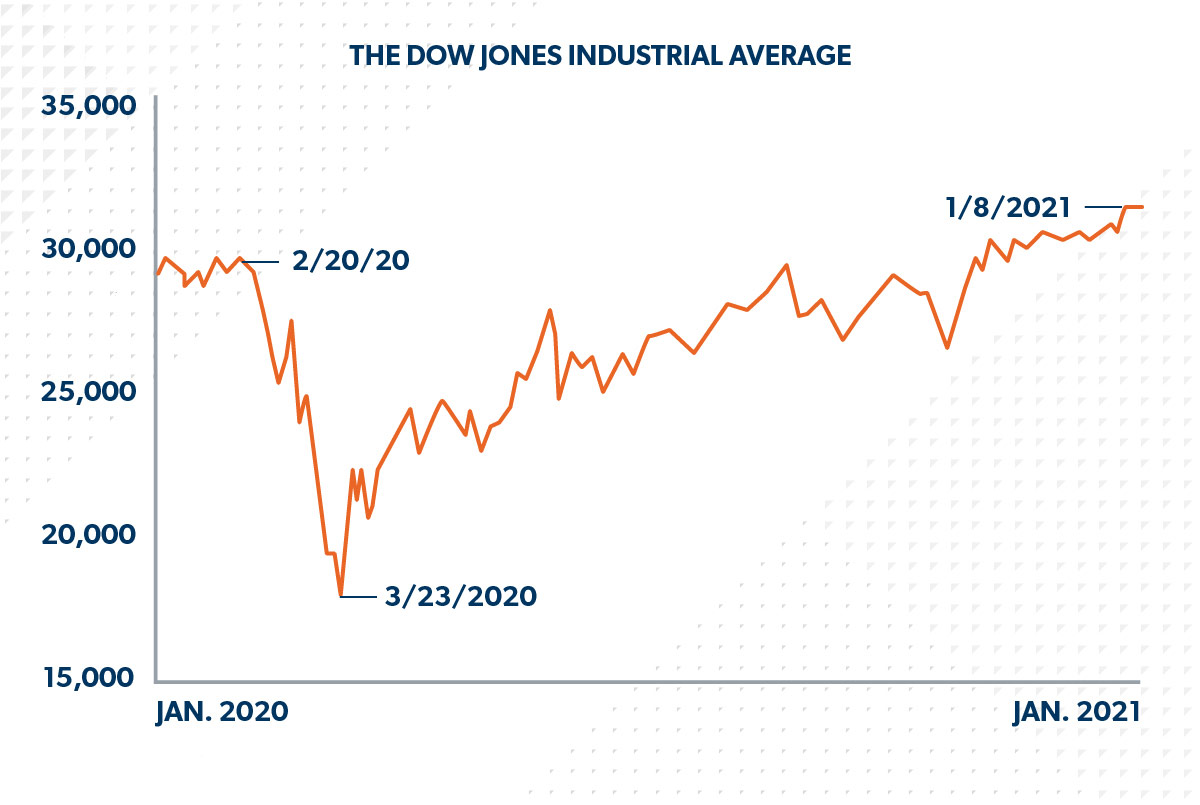

To get an overall idea of the value of stocks, we look at indexes (that's something that tracks how well stocks do) like the Dow Jones Industrial Average (DJIA), the S&P 500 and the Nasdaq. If you expect at a visual graph of one of these indexes, yous tin can see why we use the termcrash. It's like watching a aeroplane have a nose dive.

Previous Stock Marketplace Crashes: Examples From History

Throughout history, the marketplace has gone through a lot of extreme ups and downs. When we await dorsum, nosotros're reminded that, yes, a market crash is a very difficult thing to go through, merely it's something we tin and will overcome.

- The Groovy Depression,1929: Over the class of a few days, the DJIA dropped nearly 25%.3 Information technology took a niggling over a decade for the economy to get dorsum to predepression levels. It was the industry from World War 2 that helped get things back up and running.

- The Stock Market place Crash, 1987: The market lost 22.6% of its value in one day known as Blackness Mon.4 But within 2 years, it had recovered everything it had lost.five

- September 11, 2001:Terrorist attacks in our state caused a major hit on the marketplace, simply information technology corrected itself super quick. Just one month later, the stock market had returned to September 10 levels and kept going up throughout the stop of 2001.6

- The Great Recession, 2008:The DJIA lost more than than 50% of its value in a actually curt time.vii But afterwards a couple of years, the market was stronger than ever before—nosotros were basically in a bull market (a period of large economical growth) from 2009 to just before the coronavirus crash.

- The Coronavirus Crash, 2020: In March of 2020, the COVID-19 pandemic triggered the nigh rapid global crash in financial history. Even so, the stock market recovered ground pretty quick, and the year closed with tape highs.8

And so, proceed your caput up. Chances are, you lot've already lived through two major crashes and recessions. It's role of the rhythm of life!

What Causes a Stock Market Crash?

A stock market crash is caused by two things: a dramatic drop in stock prices and panic. Here'south how information technology works: Stocks are small shares of a company, and investors who buy them make a turn a profit when the value of their stock goes upwardly. The value and the price of those stocks are based on how well investors believe the visitor volition do. So, if they remember the company they're invested in is headed for difficult times, they sell that stock in an attempt to leave earlier the value drops.

The reality is, panic has only every bit big of a role in a stock marketplace crash as the actual economic issues that cause information technology.

Let's walk through an instance from the coronavirus pandemic that shows you just how powerful panic is. Every bit news of the virus spread, grocery and convenience stores all across the world sold out of toilet paper in a matter of days. Was there a toilet paper shortage? Well, aye and no. In that location wasn't a shortage before people started panicking. Just when people lost their minds and started stocking upwardly on toilet paper, their actions created a shortage!

The aforementioned kind of panic can trigger a stock market crash. In one case investors see other investors selling off their stocks, they go pretty nervous. Then, stock values start to dip, and more investors sell their shares. Side by side thing you know, everyone is dumping their stocks, and the marketplace is in a full-fledged crash. Wait out below!

Our point here is this: The stock market's value is 100% based onperception andprediction of the future. No wonder it feels like such a roller coaster ride!

How Did the Coronavirus Crash Bear upon the Stock Market?

Let's pretend nosotros've got a time automobile to take us back to March of 2020 when the coronavirus was officially declared a pandemic (don't worry, we won't stay long). While people were binge-watchingTiger King or swarming the supermarkets to buy toilet paper, the global economic system was in anarchy. Supply bondage ground to a halt. Entire industries shut down overnight. And the stock market crashed—big time.

Dorsum in the early days of the pandemic, the stock market took united states all on a ride. Global markets (not only here in the U.S.) took a huge plunge, triggering a brusque-lived acquit market (where the stock market falls by at least twenty%) and an economic recession in the next few months. If yous were checking your 401(k) during those days, y'all probably felt panicked as yous watched your savings disappear.

Merely after the initial nose dive in March, the market started to inch its way dorsum to recovery. And by the fourth dimension the New Year'south Eve brawl dropped on December 31, 2020, the stock market had regained all of its lost footing—and then some! Did you lot grab that? All of the major indexes grew in 2020:nine

- The S&P 500 gained 15.6%.

- The Nasdaq gained 43.eight%.

- The Dow Jones gained 6.5%.

We still have a route alee of u.s. in 2021, merely looking back, we can see that fifty-fifty the large, scary coronavirus crash didn't knock us out for long. In fact, economists are now saying the recession from the coronavirus crash was the shortest on record—simply lasting two months!10

Will the Stock Market Crash in 2021?

All right, let's simply say information technology: Even though stocks took a tumble in July—for a day—that doesn't hateful that "the big i" is on the manner. Let's become one affair straight:No 1 tin can perfectly predict whether or not the stock market is going to crash during the rest of 2021. Just think dorsum to everything that happened last twelvemonth—you lot tin can't make this stuff upwards!

And then, will the stock market crash in 2021? All we can practise is wait at the things that will influence the market place and your investments throughout the rest of the yr. The good news is that major financial analysts predicted steady growth of the bull market in 2021.xi Just allow'south look at the specifics and where nosotros are now.

Reasons to Feel Cautious About the Stock Market in 2021:

- COVID-19: The coronavirus isn't going anywhere, and new strains like the Delta variant are causing case numbers to go upward.12

- Unemployment: Although we've recovered millions of jobs since the country was hit hard in 2020, we're however experiencing huge unemployment numbers.13

- Aggrandizement: Those stimulus checks come at a cost. With more government spending, we've seen an increase in inflation, which has lead to investors pulling dorsum and beingness cautious.

Reasons to Feel Optimistic About the Stock Market in 2021:

- Vaccinations: As more than people became vaccinated for the coronavirus, the stock marketplace responded in a positive mode. We've already seen more than optimism, movement and spending. At that place's a lot of pent-upwards energy in our state, and people are ready to get out and about!

- One-time industries reopening: As the world continues to reopen, nosotros'll see certain businesses gain value in their stocks again (think oil, travel and entertainment).

- New industries growing: Specific industries—tech, e-commerce and biotech—gained tons of footing during the pandemic and will continue to grow and give investors reason to feel confident.fourteen

- Depression involvement rates: The Federal Reserve has promised to keep interest rates nearly goose egg until at least 2023, which will encourage spending.15

We can run numbers and brand predictions all day long, merely at the terminate of the twenty-four hours, nosotros have no thought what's going to happen for the remainder of 2021—no ane does. Then allow's be the kind of people who are prepared for anything the future has in store.

What to Do During a Stock Market Crash

If the market place does crash once more in 2021, remind yourself that you lived through another crash just last year. In the middle of chaos, y'all've got to focus on what you tin control: your attitude, your outlook and your actions. Of class, a crash is scary. Yep, you'll have to make some changes. But with the right plan to move forrard, we can and will continue to make progress. Here are five means you can respond to a stock market crash:

1. Reject to panic.

Similar we said earlier, panic can brand the crash simply every bit bad as the actual economical problems we're facing. Don't fall for it. Dealing with the unknown creates incertitude, and dubiousness left unchecked tin become fearfulness. Choose to stay clear and positive with your thoughts.

2. Cut back on everything.

You lot can't control how Congress makes their upkeep, but you tin command howyou lot make your budget! If the economy goes under, information technology means it's time to cutting outall unnecessary spending ofany blazon. Abolish your gym membership, and don't even recollect about having an online shopping spree! Meal plan to save money. Use up the food that y'all have in your pantry and freezer earlier you lot get out and purchase more than.

Focus on funding the Four Walls earlier anything else:

- Food

- Utilities

- Shelter

- Transportation

Protect yourself and your family unit. Tighten the budget and hang in there.

3. Follow the proven plan.

Pelting or shine, the Baby Steps don't alter. They're the proven program for managing your money, and they piece of work! Yous need to understand which step yous're on so work the programme.

If you lot've lost your income: Focus on piling up as much cash as you can. You can pause paying actress toward debt right now. Every bit much as that stinks, don't worry—it'due south not forever. When the tough time passes—and information technology will—and then yous tin can get-go support and pay actress on your debt.

If your income is stable: Keep right on working the Baby Steps like you were, and don't pause your debt snowball. Stay on the program!

4. If yous're investing, stay invested.

If yous're on Baby Step four, keep investing xv% of your income (unless you need to suspension for a while because you lost your income). Lots of people are tempted to cash out their 401(m) or mutual funds when the market takes a nose dive before they "lose any more than coin." Just if you pull out now, you lot'll guarantee a loss. Stay plugged in and ride it out to requite your investments more than time to grow and recover. Don't try to time the market place. Focus ontime in the marketplace.

5. See with an investment professional.

When there are large shifts in the market, schedule a call with your investment professional. Y'all demand specific advice for your state of affairs—your age, your funds, the types of retirement accounts you have, and which Infant Step you're on. Ask your pro if you need to make any changes considering of the crash. Don't be afraid to share what's on your mind. If you're married, brand sure your spouse is on the phone call! Make a plan for how y'all'll motility frontwards together.

And past the fashion, if you've been playing the investment game without a pro in your corner—don't. Connect with an investment professional in your area.

Stay Calm During a Stock Marketplace Crash

You've got to choose to be patient and think long term hither. No matter what the remainder of 2021 has in store, remind yourself of the things you know to be true. You intendance well-nigh your family, your dreams and your time to come—so brand your investment decisions with those things in listen. You'll do a much better job of that if you lot stay positive and focus on the factors that you can control. Then hang tight, take it one day at a time, and we'll all get through the rest of this year together.

Well-nigh the writer

Ramsey Solutions

cayerwalouteemper2001.blogspot.com

Source: https://www.ramseysolutions.com/retirement/stock-market-crash

0 Response to "Is the Free Market Going to Crash Again"

Post a Comment